Vanguard

An assortment of projects from my work on the Vanguard app.

Want more samples, or more insight on my thought process for these? Feel free to reach out on my LinkedIn.

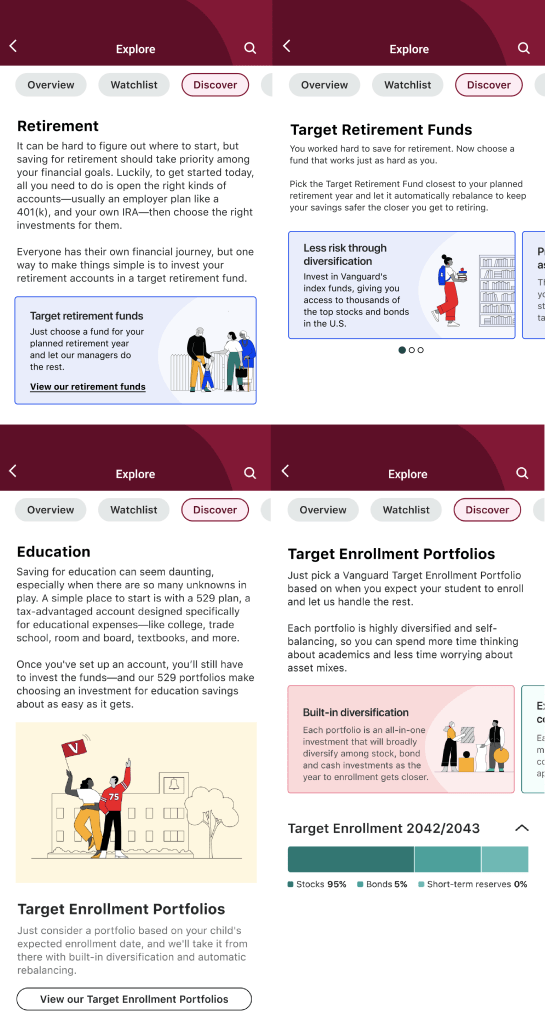

Browse

Challenge:

Create an experience that guides novice investors through the daunting start of their investment journey and the wide array of Vanguard investment product offerings, and gives them an idea of where, and how, to start.

Solution:

After significant user testing and studying up on personal finance best practices, flesh out two main browse experiences: Browse by product type (mutual funds, ETFs, etc. – not pictured) and Browse by goal (retirement, education, emergency fund).

Emphasize at each point the distinction—and, importantly, the connection—between investment account types and investment products. Encourage healthy investment behaviors by promoting hands-off, highly diversified, self-managing funds designed for specific financial goals, and follow the web team’s lead with regards to the investment products Vanguard is comfortable pushing.

All in all, create an empathetic, human-friendly experience that guides first-time investors through their first (hopefully first of many!) responsible investment.

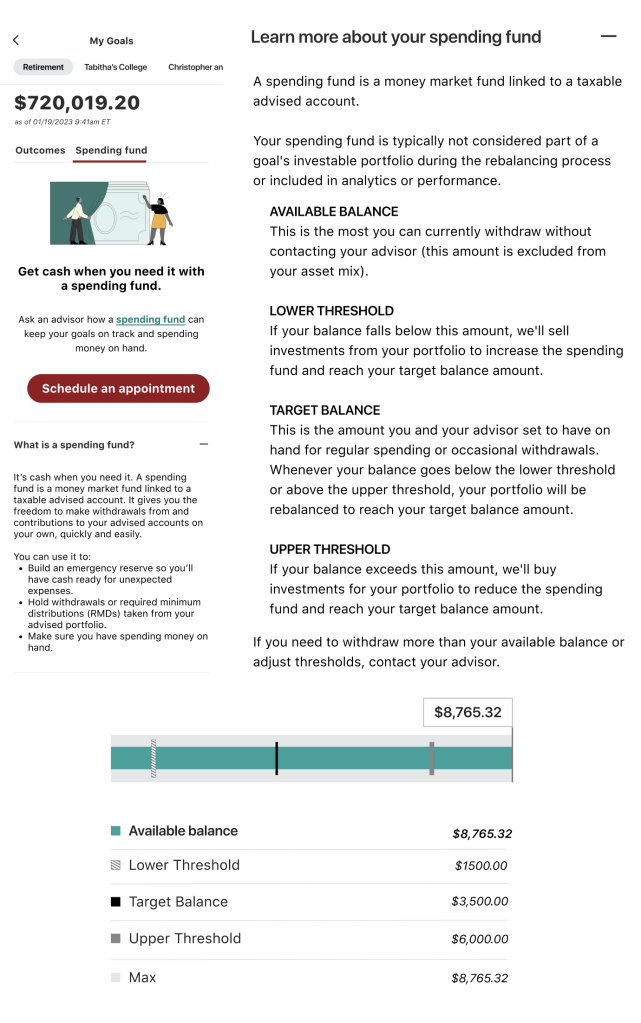

Spending fund

Challenge:

Explain to Vanguard Personal Advisor clients the concept of a “spending fund,” a feature that allows them to withdraw from or contribute to accounts that usually only their advisors have access to. Explanations of how a spending fund actually works have confused clients in user research sessions (and our own team at times).

Solution:

Encourage clients without a spending fund to speak to their advisors about how it works, and provide some examples on what can be done with it to build a mental model of its liquidity.

Provide a visualization of the spending fund and its key properties, and pair it with thorough definitions that explain how it behaves in different circumstances.

Goals

Challenge:

Rework the existing retirement prediction content (left) into something more digestible.

Solution:

After many meetings trying to understand how these calculations are actually made, cut out the parts irrelevant to the client (what do you mean $1 remaining at age 100?!) and add in what is.

Leave the more technical jargon for more curious clients in an accordion below and remember: clients paying for an advisor are probably not clients who want to get into the weeds of their finances.

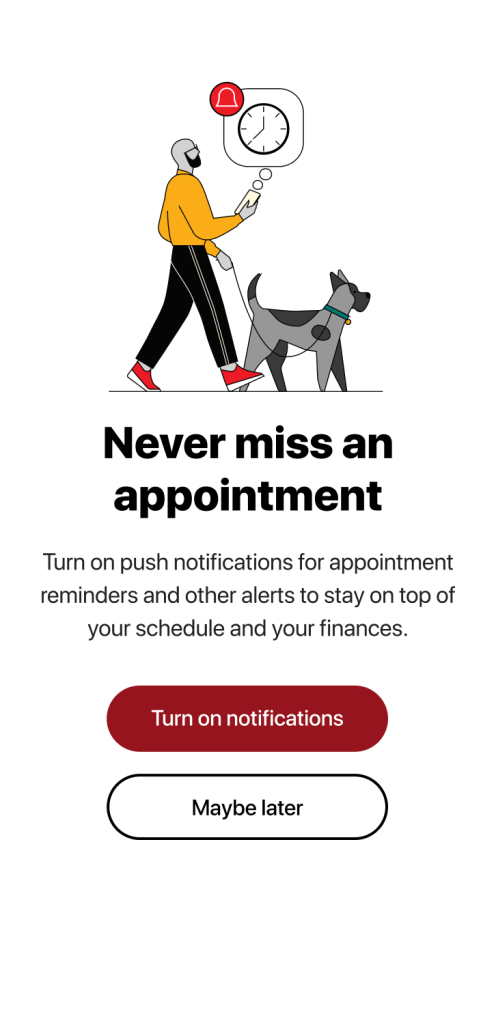

Appointment notifications

Challenge:

Encourage users to turn on push notifications for the Vanguard app. Technical constraints mean push notifications are “all-or-nothing”: if you turn on push for appointments, you’ll also be turning on push notifications for everything else. We also don’t want to bug the user with constant requests to turn on push.

Solution:

Lead with a punchy value prop, make note of “other alerts” that help you keep up with your general finances (not just appointment reminders for staying on top of your schedule), and put it all in a screen that shows up when it’s most relevant: right after the user schedules or edits an appointment.